Megacable

4.1x EBITDA, 7.2% dividend yield for leading Mexican fibre business with latent growth potential

Market cap: MX$ 40.5bn | Enterprise value: MX$61.6bn | EV / LTM EBITDA: 4.1x

Megacable (ticker: MEGA CPO) is a fibre business that provides internet, video, telephony, mobile and corporate services to 5.6m unique subscribers in Mexico. The business announced a large FTTH (fibre to the home) expansion starting in Q3 of 2021 at which point they had 9.3m homes passed. The plan was to double their fibre footprint to 19m homes passed over three to four years. They would target markets where there may be some competition, but they expected to achieve 20% to 30% penetration in the expansion territories. This penetration level would give them more than 15% return on investment. The expansion would be funded with internal cash and some debt. They started the expansion underleveraged with just 0.4x net debt to EBITDA.

Despite executing well, it’s fair to say that the market has not liked the plan. The following graph shows the EBITDA multiple and share price of Megacable since announcing the expansion in 2021.

Three and a half years later, Megacable have now passed 17.6m homes. They’ve spent most of the expansion capex, which is in the EV, but EBITDA does not yet fully reflect this investment. A new fibre area takes 3-5 years to fully mature in terms of penetration, so the very first few homes passed in the expansion are only coming to maturity now. Management have said that their average penetration is 13% across expansion territories and they are on track for their 25% penetration target. At an average age of 1.75 years and half the target penetration reached, they do indeed seem on track. At 1.4x net debt to EBITDA their current debt is low for a fibre business. So the capex is largely spent and in the EV, EBITDA is ramping up, and yet the EV / EBITDA multiple is currently at just 4.1x from near 7x at the start of 2021. As the capex comes down and the EBITDA increases with more penetration, Megacable will see a substantial increase in free cash flow. Management also has a long track record of paying out most of the free cash flow in dividends. Megacable has just declared an annual dividend of MX$2.9bn, 7.2% of the market cap. The dividend payment date is typically in May each year, so an investment today can be viewed as having an effective 7.2% discount since the dividend is not far away.

This is a stable, recurring revenue business with substantial and valuable fixed assets that caters to a real consumer need. Its earnings have latent growth potential from the fibre expansion and management does shareholder-friendly things with the cash. Yet it trades at 4.1x LTM EBITDA. The normal market multiple for this type of business is 6x to 8x EBITDA. The main risks pertain to lower video subscriptions over time (cord-cutting), the potential for more government regulation and (depending on where you’re investing from) currency depreciation. I view this investment as being likely to at least double over three years with minimal risk to capital even in a pessimistic scenario. It’s the type of asymmetric bet I like.

Disclaimer: I own this stock, so I may be biased. Adjust your views accordingly.

Mexico – not your ideal investment destination?

If you’re anything like me, you’ve probably read this far and you can’t get the word “Mexico” out of your mind. Let’s address this straight away. Megacable is in Mexico. Depending on your experiences, that might make you think of beautiful beaches and great food, or it may elicit images of drug cartels and a volatile third-world currency. There is also a tariff war underway. Why invest one’s capital in Mexico?

First, their central bank is conservatively run. Mexican CPI has averaged 4.8% p.a. over the last decade versus the US average of 3.1%. The benchmark interest rate in Mexico is currently 9.0% despite an inflation rate of 3.8%. Over the last 20 years the Mexican Peso has declined by an average of 3.1% per annum to the US dollar. This average exchange rate decline is vulnerable to start and end values, but 20 years is a fairly long measurement period. Mexican debt-to-GDP is 47.7%. This doesn’t scream third-world basket case to me.

Second, I think Mexico is well positioned to benefit from the recent tariff strife. I won’t pretend I can predict how the tariffs will shake out, but I think it’s fair to say that China is the bigger target for Trump’s administration. Despite the intentions to create American manufacturing jobs, there are jobs US citizens simply don’t want to do. And Mexican labour is much cheaper. Currently Mexico has not been included in the latest round of White House tariffs and most of their goods (barring autos, steel and aluminium) exported into the US are still tariff-free under the USMCA. Mexican President Sheinbaum has said that based on calls with President Trump she understands that there won’t be further tariffs on Mexico. On a relative basis, Mexico seems like a winner as things stand. Geography also matters, and not just for cost reasons. They’re closer to the US which substantially reduces supply chain security concerns.

Third, the fibre industry is not directly impacted by tariffs. A wealthier Mexican populace is obviously better for fibre adoption, but any negative tariff impact in Mexico has, at worst, only an indirect impact on fibre adoption. The internet has become a consumer need. It’s not up there with food and housing, but it probably ranks quite highly for most people.

Finally, Mexican internet penetration is at 81%. This may sound high, but a significant portion of this is mobile internet. Mexico has 26.6m fixed broadband subscriptions (not just fibre) which is about 20% of their current population. For context, internet penetration in the US is about 97% of the population with 131m fixed broadband subscriptions or 38.5% of its population. As I’ll discuss, fibre is simply the best solution in a world - driven by AI and online media - that is consuming more and more data. The runway for fibre adoption in Mexico is a long one and the correlation globally between wealth per capita and broadband adoption is very strong. As Mexicans become wealthier, they’re very likely to adopt more fibre. The average Mexican is becoming wealthier, with GDP per capita in US dollars growing 2.7% p.a. since 2000.

Now to be fair, crime is a real problem in Mexico. The homicides per 100,000 people is currently about 25. This is not abnormal in Latin America, but it’s obviously far higher than any country would want. It’s much higher than in the US. Crime undoubtedly reduces investment in the country and increases the cost of doing business. But crime in Mexico is not new. It’s also top-of-mind given Mexico’s proximity to the US and therefore US media coverage, so is possibly given too much weight in people’s minds. Mexico has grown its real GDP by 2% p.a. since 2000 despite its crime problem. And the fibre business is not particularly vulnerable to crime.

A brief history of Megacable – growing and upgrading its network to fiber

Megacable listed on the Mexican Stock Market in 2007 with 1.3m cable subscribers, 400k internet subscribers and 100k telephone subscribers across 178 municipalities. It subsequently acquired several cable systems to broaden its network. By 2011 it had almost 2m cable subscribers and 650k internet subscribers. Megacable started paying a dividend in 2012 and has done so every year since, increasing at a rate of about 14% per annum. Megacable also grew its corporate offering over this time, starting with MetroCarrier and MCM followed by an acquisition of ho1a in 2013 (51%) and 2018 (remaining 49%). The company launched its Xview platform in 2017, a video-on-demand and live TV offering.

In 2020 the company embarked on its GPON evolution project to migrate 4m homes passed to FTTH technology. Megacable announced its MEGA 2024 expansion project in Q3 of 2021, aiming to double its fibre infrastructure over 3 to 4 years by expanding into new territories. At this stage it had about 9.3m homes passed and 4.1m unique subscribers. MEGA 2024 is nearing completion with 17.6m homes passed and 5.6m unique subscribers at the end of Q1 2025. Additionally, 80% of its network is fibre.

The company is effectively controlled by the Robinson Bours (42%) and Mazon (11%) families. Megacable is run by professional non-family managers that have been with the company for a long time. Enrique Robles is the CEO, owns 6% of the shares, and has been with the company since 1982. Despite the family control dynamic, the company has a very long history of treating minority shareholders well. The Robinson Bours family also has a good track record with the listed poultry business Industrias Bachoco, which they took from 5 to 88 (excl. dividends) over a 20-year timespan.

Megacable has consistently grown its EBITDA, compounding at about 13% per year since 2006 with minimal net debt while maintaining a healthy dividend that is currently yielding 7.2%.

The competitive environment for Mexican fibre – four major players with Megacable taking share

Mexico is a large country that is highly urbanized (81%). This makes it good for fibre which is far less economical when people live further apart in rural areas. When laying fibre you pay for the distance covered, so if you pass more homes your fibre offers better returns because you can sign up more customers for the same cost. Fibre is generally uneconomical is rural areas where solutions like satellite potentially offer better value. Fibre is superior to DSL and coaxial cable in terms of the speed and bandwidth it can offer, which is why Megacable has been upgrading their legacy network to fibre.

The main fibre competitors in Mexico are Telmex, TotalPlay and Izzi:

Telmex is the largest, starting as government-owned and then being privatized in 1990 by a consortium led by Carlos Slim. It is owned by America Movil. It is not allowed to offer pay-TV services due to its size in the market. It is struggling financially and “has been operating at a loss for a decade” according to a 2024 statement by Carlos Slim. Its not clear how many broadband subscribers it has in Mexico, but according to Convergencia Latina it has lost 25% of its market share in fixed broadband over the last 5 years. Despite its losses it currently offers some of the cheapest packages in the market – for how long remains to be seen.

TotalPlay is arguably Megacable’s biggest direct competitor, certainly in their legacy regions where the two companies overlap in 60% of Megacable’s regions. It is owned by a Mexican holding company called Grupo Salinas. It has 4.8m broadband subscribers from about 17.6m homes passed, a penetration of 27%. TotalPlay has recently slowed its build-out plans to focus on profitability.

Izzi is owned by Grupo Televisa. It tried to merge with Megacable in 2022 but the deal collapsed. Izzi has 5.6m broadband subscribers from 19.9m homes passed, a penetration of 28%. It has recently been losing subscribers.

Megacable’s recent expansion seems to have put pressure on both TotalPlay (slowing their expansion) and Izzi (losing subscribers). For comparison, Megacable has 5.6m subscribers from 17.6m homes passed, a penetration of 31%. Its penetration before embarking on its MEGA 2024 expansion was 40%.

In terms of pricing in the market, lets just say its complex. A consumer is likely to only have a couple of options in their region when choosing a fibre provider and then comparing them seems to have been made deliberately difficult with a myriad of nuanced offerings. Megacable’s management have said that after initial promotional periods, they are MX$10 to MX$40 cheaper than their competitors. Megacable are also being aggressive in their promotional rates as they look to sign up new customers in their expansion territories. They are known to be the cheapest in the market, but I wouldn’t take this at face value. Telmex are certainly being very aggressive on pricing themselves.

The following table is my summary of some fibre offerings in the market. I say “my summary” because there seems to be lots of conflicting information out there. I’ve focused on the cheaper 100mbps offerings although all the companies offer faster speeds as well. Double play packages are just internet and telephony whereas triple play packages also include TV. Some packages are symmetrical (upload and download speeds the same) and some aren’t, although all provider do have symmetrical offerings. For a price-conscious consumer I assume they’d opt for an asymmetrical package unless they specifically need that upload speed. Most providers offer some sort of discount in the first three or six months, but this isn’t always clear. Discounts may also differ by region. All of these providers also bundle streaming services like Netflix, HBO and Paramount+ for higher rates but I’ve excluded such packages from the table below.

So Megacable do appear to be price-competitive, especially with their promotional discounts. Megacable also seem to have shorter initial contract periods, presumably taking the view that a long contract period might scare customers off the initial purchase and once you’ve experienced fibre at home you’re likely to keep it.

Telmex stands out here as not having a triple play package. They offer symmetrical speeds for their double package at very attractive rates, comparing favorably on normal pricing with the other three companies. But based on comments from several sources the company is clearly struggling financially and bleeding market share to competitors. It is not a new story: a legacy telecom provider, once government-owned, struggles to compete with new competitors in a changing market.

The corporate segment and mobile offering

All the discussion so far has been on the FTTH offering because this is where the expansion is focused and most of the money is already coming from. The corporate segment offers services to businesses and government across the country. These services include internet, cybersecurity, disaster recovery and cloud services. The corporate segment makes up 17% of revenues and less than 5% of EBITDA. This EBITDA hasn’t grown over the last five years so I don’t expect much from this segment. Management have recently consolidated the three corporate brands into one business to save costs.

Megacable also offer mobile services to its existing subscribers. This is an MVNO (mobile virtual private network) where it partners with Altan and AT&T to provide mobile services to its subscribers. An MVNO buys data and minutes at wholesale rates from other providers and sells them on to their customers. Megacable have said they make 15% - 20% margins on this business which is much lower than their other mass market offering, but since they don’t own the infrastructure it is capital light. They currently have about 575k mobile subscribers, almost all of which are on post-paid contracts.

Financial history and key metrics – it’s all about penetration and EBITDA margin

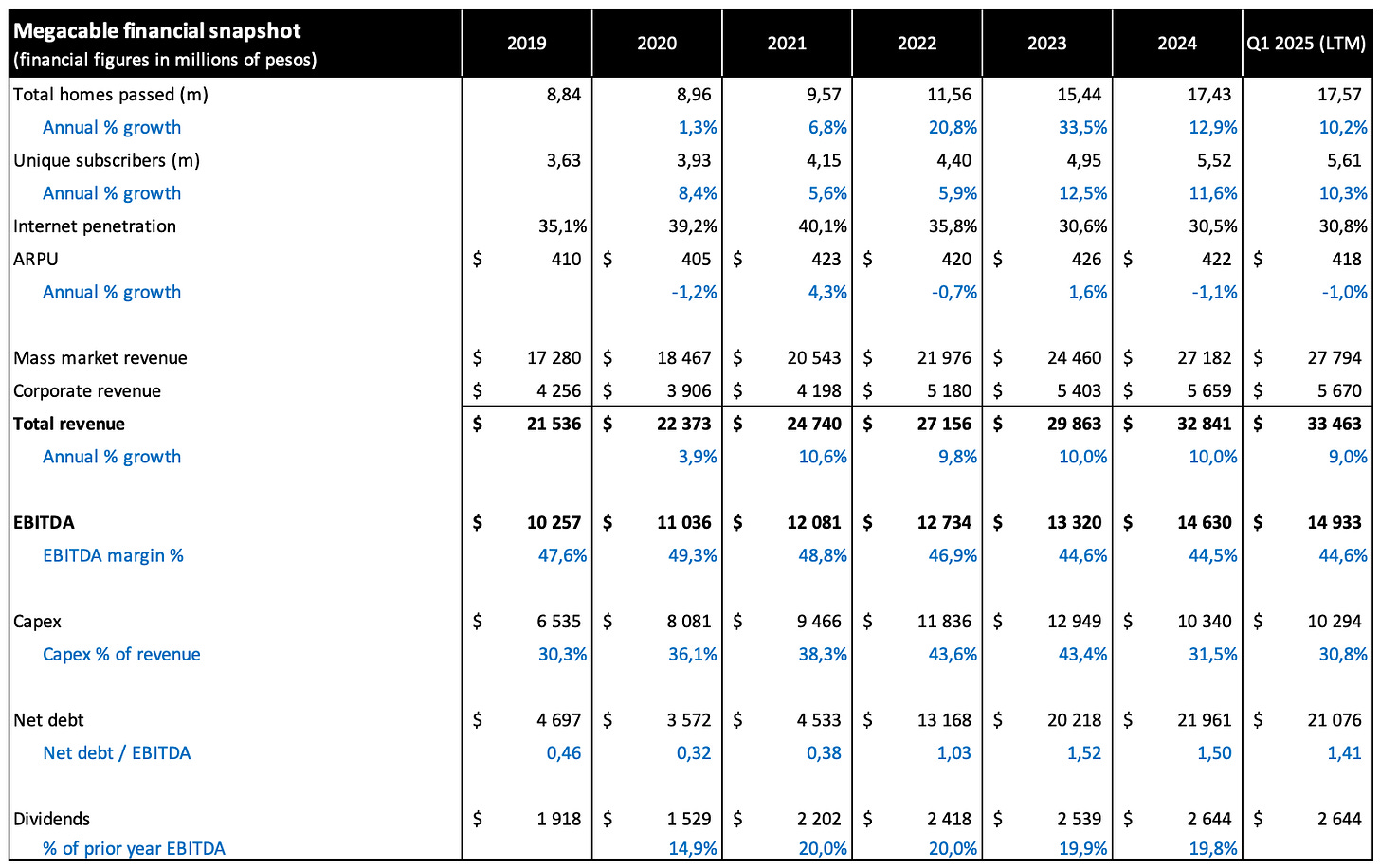

I’ve summarised the key financial metrics for Megacable below for the last few years. The table tells the recent story of Megacable quite succinctly:

homes passed ramp up dramatically after 2021 along with capex as the MEGA 2024 expansion starts

unique subscriber growth increases, but at a slower pace than homes passed due to the lag in signing up new subscribers in the expansion territories

internet penetration falls from its peak of 40% as new subscribers lag the rapid growth in homes passed

ARPU doesn’t really grow much once the expansion starts, partly due to the promotional discounts offered to new subscribers but also partly due to fewer people opting for the higher-priced packages that include video

mass market revenue grows much faster than corporate revenue since the expansion is focused on fibre-to-the-home

EBITDA margin falls from its high of close to 50% as operational costs increase to accommodate the expansion, but new subscribers sign on with a lag

net debt expands, both nominally and relative to EBITDA, to fund the expansion

despite the increased capex, dividends have grown consistently throughout the expansion and are going to be MX$2.9bn in 2025, or 20% of 2024’s EBITDA

Since Megacable planned on increasing their homes passed to about 19m, one can expect their capex spend to slow now that they are reaching this target. Management have said to expect capex as a percentage of revenue to reduce to about 28% in 2025 and then drop to the low 20s by 2027. To me this implies that they may slightly surpass their 19m homes target since maintenance capex is probably closer to 15% - 20% of revenues. The following graph shows the slowing incremental homes passed per quarter as well as the total homes passed nearing the 19m target:

Internet penetration initially decreased rapidly with the expansion and is now starting to increase again. Megacable won’t get back to the 40% level from 2021 because the expansion territories have more competition than the legacy territories. Management is targeting 25% penetration in the expansion territories. So broadly speaking if half the homes passed are at 40% penetration and half at 25% then we should get back to about 32.5% penetration overall if the expansion meets managements targets. In the Q3 2024 earnings call management said that they’ve achieved 13% penetration in the expansion territories. With an average age of 1.75 years on the expansion territories and a typical minimum of at least 3 years to reach maturity, this 13% level is encouraging for reaching their 25% target. Given the strong promotional pricing and management’s long track record of execution, I think they’ve likely chosen good expansion territories and will meet or even exceed their penetration target. The following graph shows the total number of subscribers growing despite the lower penetration rate:

The EBITDA margin is starting to increase, and management have guided to getting back to about 47% in the longer term. This is lower than their peak margins of close to 50%, perhaps reflecting the heightened competition in the expansion territories. There has also been an increase in the minimum wage in Mexico over the last five years which has likely had a dampening effect on overall margins. This wage increase is evidence of a left-leaning government favoring more socialist policies. The following graph shows the EBITDA margin and number of employees at Megacable over recent years:

When combining the declining penetration rates with the competition in the market, one could be excused for wondering whether the legacy territories are losing customers. Or whether the cord-cutting trend in other markets combined with the stagnating ARPU is evidence of Megacable losing video customers to lower-priced packages. The following graph shows the churn rates across internet, video and telephony:

Churn has been controlled throughout the expansion period across all three segments. This is likely testament to Megacable’s GPON upgrade of its legacy cable network to fibre which helps them to retain their legacy customers by offering higher speeds. Video churn has been slightly higher than internet churn in the last 7 quarters and total video subscribers have decreased by about 1% over this period as more new subscribers opt for double play over triple play packages.

Although video is likely to form a smaller part of the future Megacable business, I don’t expect a dramatic decline like that seen in the US. The marginal cost of going from double play to triple play packages that include video (±MX$150) is less than a standard Netflix subscription (MX$249). Although Netflix with ads is MX$119, the gap to Megacable’s incremental video price is small, especially compared to the difference between cable subscriptions and streaming subscriptions in the US. In addition, some of the most popular content in Mexico (Liga MX football, Lucha Libre wrestling, Mexican soap operas, etc.) is not available on multinational streaming platforms.

What is a reasonable multiple for this type of business?

Let me start by saying I don’t think its 4.1x EBITDA. I think a general decline in the Mexican stock market valuation (in line with developing market peers) combined with Megacable screening poorly probably explains the current valuation. If you just run a screen on the consolidated financials of the company, yes you see a low multiple and high dividend, but you also see declining margins, large capex and rapidly increasing debt. For a sector that attracts investors focused on steady recurring cash flows, Megacable probably doesn’t jump out as a prize pony.

For context, here is the recent valuation of the Mexican stock market since 1995. It’s not historically low but has certainly sold off in the last few years:

But what is the right valuation? Let’s consider at a few listed peers. The following graph shows the EV / LTM EBITDA multiples of four other fibre providers in Latin America over the last five years. With the exception of TLEVISA CPO (owner of Izzi) which is really struggling, the other three have all averaged near or above 6x EV / EBITDA over the five years. You can see the average multiple in the text above the graph next to each company name… where it says “Mean”.

In terms of private market multiples, this is slightly more difficult to find, especially in developing markets. Izzi’s parent company Grupo Televisa did try to merge with Megacable in 2022, but since it was a merger, it didn’t establish an absolute price on Megacable. As per an S&P Global article from November 2022, the average price paid per fibre mile in the US was $99,345 across 34 transactions since 2015. This would value Megacable’s 82,000km of fibre at MX$99bn or 6.6x EV / EBITDA, a valuation which excludes the corporate segment and remaining 20,000km legacy cable network. However, the valuation of $99,345 per fibre mile is also for US assets so not directly comparable given the market differences.

The last data point is more anecdotal. Having chatted to a friend involved in a fibre business in a developing market not too dissimilar to Mexico, private market valuations tend to be between 6x and 8x EV / EBITDA. This translates to 8% - 12% FCF yields for a recurring revenue mature fibre business with some ability to raise prices with inflation, which seems reasonable in higher interest rate markets.

In summary, I think that Megacable should demand a multiple of at least 6x EV / EBITDA once the current expansion has largely played out. If the prospects for further improving penetration on the existing network are still decent at that stage – which I think is likely given Mexico’s demographic setup – the multiple should be closer to 7x EBITDA.

What exactly is the catalyst for the multiple at Megacable improving? I think its increasing free cash flow (as capex comes down and EBITDA goes up with more penetration) coupled with a higher dividend. The dividend is already 7.2% and is likely to go higher from here. The returns on capital employed will also improve as the expansion territories adopt fibre, returning this closer to the 15% ROCE business it was before.

Is EBITDA the right valuation metric for this business? It doesn’t correspond to cash after all, especially for an asset-heavy business, and cash is what really matters. Since fibre companies are mostly valued on EBITDA, it makes it easier to compare valuations. In the case of Megacable, EBIT or PE also both suffer from having a high depreciation in earnings due to the recent expansion without the corresponding revenue for that level of investment. As penetration improves that relationship should normalise. For now, EBITDA seems like the best metric for valuation purposes.

Where will the company be once the expansion is complete?

Let’s have some fun and prognosticate. These are (educated) guesses and should be treated as such, but I think they sketch a picture of where Megacable is likely to go from here.

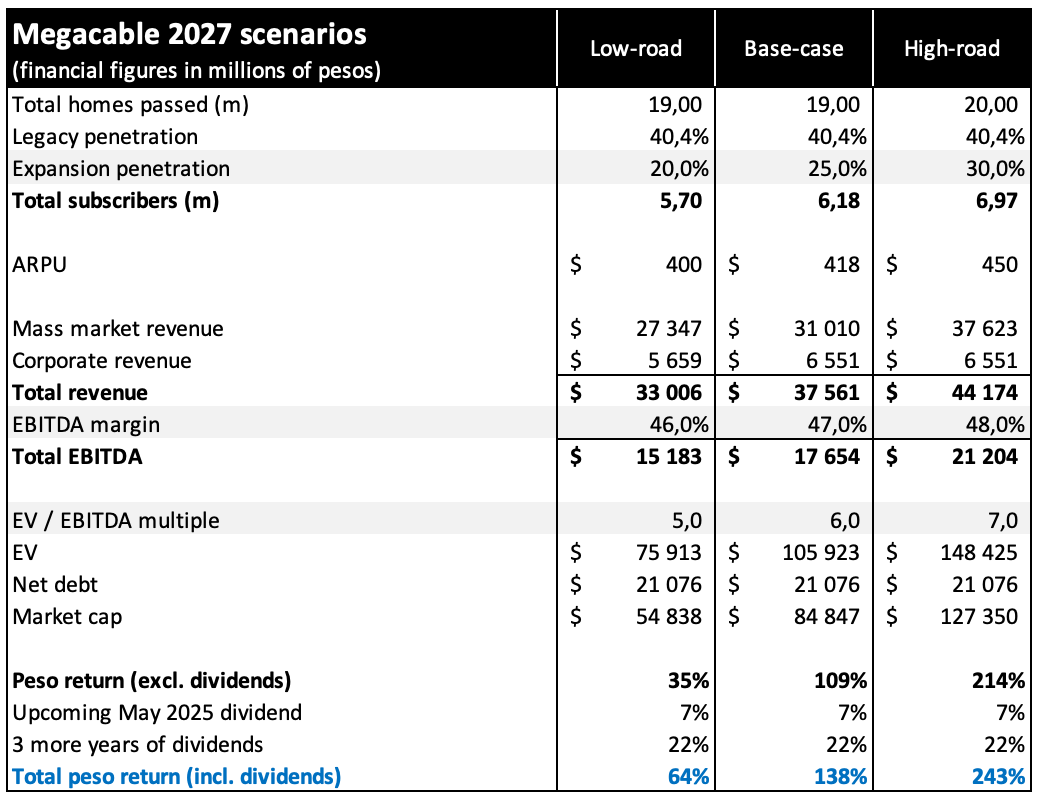

Given that we’re in a growth phase with penetration, subscribers and EBITDA margin all likely to increase, where could Megacable be in 3 years? Based on a few key assumptions that have been highlighted, I’ve laid this out under a three scenarios below:

I consider the base-case to be the most likely outcome, returning 138%. The expansion penetration reaches management’s target of 25%, ARPU doesn’t grow as lower video take-up is offset by subscribers rolling off promotional pricing as well as general price increases, corporate revenue grows 5% per year for three years and the EBITDA margin reaches management’s target of 47%. I’ve illustrated how the EBITDA multiple of 6x is on the lower end for this type of asset. All these assumptions strike me as very achievable.

Under the low-road, expansion falters and only achieves 20% penetration, ARPU declines a little with people dropping video packages which is not fully offset by promotional roll-offs or increases, corporate revenue doesn’t grow, the EBITDA margin doesn’t improve from the last quarter and the market punishes Megacable with a below-average 5x multiple. None of these assumptions are ridiculous but they strike me as quite pessimistic and not supported by the history or recent trends.

Under the high-road slightly more homes are passed, expansion penetration hits the high-end of management’s stated range and ARPU expands by about 7.5% from here with more subscribers signing up for larger packages as the demand for data grows. The EBITDA multiple is also more in line with well-run fibre business that still has good growth prospects ahead of it. Although not the most likely outcome, I think this scenario is more likely than the low-road. Peso returns are very attractive at more than 240% under the high-road.

Under all three scenarios you make a positive return from here. Under the base-case and high-road your returns are particularly attractive. Note that the next dividend is due in a little over a month and I’ve included subsequent dividends at the same rate, although I think they’re likely to also increase. But a balance will be struck between paying down debt and increasing the dividend. In the scenarios I’ve assumed that net debt is maintained as the expansion slows and free cash flow ramps up, but they could decide to reduce the debt in lieu of increasing the dividend. Historically Megacable has been run very conservatively from a debt perspective. Either way this should reflect in returns for shareholders since a lower net debt figure should improve the market cap given the same EV multiple. Don’t expect buybacks. It would be ideal given the valuation but management has not been very receptive to the suggestion.

Given the risks and potential returns I consider this to be a highly asymmetric opportunity with a positive return even under a downside scenarios and very attractive returns under normal circumstances. All of this is bolstered by an attractive and likely increasing dividend yield.

What can go wrong?

I think it’s probably a good idea to end off with a dose of skepticism. I’ve got no interest in “pitching” this idea to you. That would also likely entrench the idea in my own head which doesn’t help me either. Let’s consider the risks fully.

The first major risk I see is government regulation. I’ve already discussed why I think Mexico isn’t a terrible geography for investors in Megacable, but I didn’t mention potential government intervention (interference?). There are a few yellow flags in this regard. The government has shown a willingness to interfere in a capitalist market when it made changes to Mexican airport concessions in 2023. When the smoke cleared this ended up not being a big deal for these companies and was implemented by the previous administration. But the current administration and new president is also left-of-centre. In April 2024, the IFT (telecoms regulator) sought to limit Megacable’s “pay-TV power” in 9 cities, requiring the company to provide its TV services wholesale to other operators. Megacable has filed an injunction for what it considers to be overreach. A similar thing happened to Televisa in 2015 for its broadcast offering. Televisa fought and overturned the ruling. If this ruling against Megacable succeeds I don’t think it does any real damage considering the limited scope. But it highlights the potential for some future unknown intervention that could do damage to Megacable, especially if it keeps taking share in the market.

Another often-cited risk is technological advancement making fibre obsolete. The current culprits are satellite and fixed-wireless solutions. Both alternatives benefit from being cheaper and faster to deploy in more sparsely populated areas. Since you don’t have to lay cable / fibre past every home but can connect to many homes from a single device, the cost per rural home is less. Although these are “new” technologies, they perform worse than fibre in denser urban areas. Both solutions are inferior to fibre when it comes to consistency of connection, speed and bandwidth. So as long as fibre is laid in appropriately populated regions it should outperform the wireless alternatives. In addition, as more and more data are consumed, the need for speed and bandwidth increases and fibre becomes an even better relative solution. I found the following graph instructive in this regard, showing the type of broadband used per 100 inhabitants for OECD countries as of December 2023:

There are regions like the Czech Republic (“Czechia”) where fixed wireless (light blue) has a large share. One of the main reasons for this is the permitting regulations in the country making the building of fibre networks slow and expensive. So fixed wireless seems to have filled the gap. But in general there is a low prevalence of satellite and fixed wireless. If these solutions are better than fibre, why are they not more prevalent? Once fibre is in the ground it seems to be the better option for consumers. It might just not get to some people.

As an aside, Mexico is second from the right. Look at the room it has to grow relative to the wealthier countries on the left in terms of broadband adoption per 100 inhabitants.

There is also a risk that other fibre operators overbuild in Megacable’s territories, reducing the company’s penetration and earnings. Currently both Izzi and Telmex are struggling financially so a massive expansion seems unlikely. TotalPlay is the strongest competitor but they have just slowed their expansion plans. Ultimately the overbuild strategy is not the most rational one since your returns on capital are significantly lower. Stealing a customer is much more difficult than bringing a customer fibre for the first time. In addition, Megacable already has very competitive pricing making competing with them in their own markets even more difficult. I think the more likely outcome is that Telmex keeps bleeding customers and if Izzi continues to struggle, they are bought out.

The last significant business risk I see is cord-cutting negatively impacting Megacable’s video adoption and therefore ARPU. The US market has experienced significant cord-cutting with subscribers opting for streaming services. Megacable is also seeing lower adoption of video services as a percentage of unique subscribers. In 2019, 89% of subscribers had video and today only 68% have video. I take comfort from the fact that the churn rates for video are only slightly higher than the churn rates for internet. As explained, I think this is partly due to a low incremental cost to add video and partly due to the range of popular Mexican content on Xview that is not available from international streamers.

The low video churn suggests that it’s mostly the new subscribers who aren’t adopting video as much, rather than the legacy subscribers cutting the cord. The current 100mbps double play package is MX$450 which is above the current overall ARPU of MX$422. So new subscribers wanting decent speeds probably won’t hurt ARPU much. As the demand for data increases, I also think the migration to higher speeds (and higher ARPU) will help to offset a slow mix shift away from video.

In terms of probability and size of impact, I think regulation has a small probability and potentially a medium sized impact if it happens. I don’t think the current technological alternatives have any impact on Megacable but future technologies are harder to predict so I’d put this likelihood as small and the impact as medium-to-high. Overbuilding seems unlikely and any impact will take a long time to show so I think the impact is also small. Lastly, video will likely continue to decline so the likelihood is high but the overall impact on Megacable is small for the reasons stated.

What about the currency? I assume most readers will be based outside of Mexico, so changes in the exchange rate matter to returns. The way I treat this is to take the returns I expect and then apply some currency devaluation assumption to those. If the net return is still attractive, then I move ahead. As an example, in the table below I’ve assumed a 5% annual decline in the currency in the base-case and 10% annual decline in the low-road. The low-road is still positive and the base case is a double in three years:

As mentioned, over the last two decades the Mexican currency has declined by an average annual rate of 3.1% to the US dollar. Some say the US dollar is somewhat overvalued today. If Mexico does benefit from a shift away from Chinese manufacturing, that could be good for the Peso. The Mexican central bank is conservatively run, debt to GDP is below 50% and inflation seems under control.

Over shorter periods the currency can of course move much more than 3%. The Peso did decline recently to the US dollar from as low as 16.50 to 19.60 over 12 months. This sudden decline was likely as a result of an unwind of the Japanese carry trade, but I’m not going to guess where the currency will go. That would be a waste of digital ink and worth even less. Given the returns I expect, I don’t think currency massively impacts the thesis.